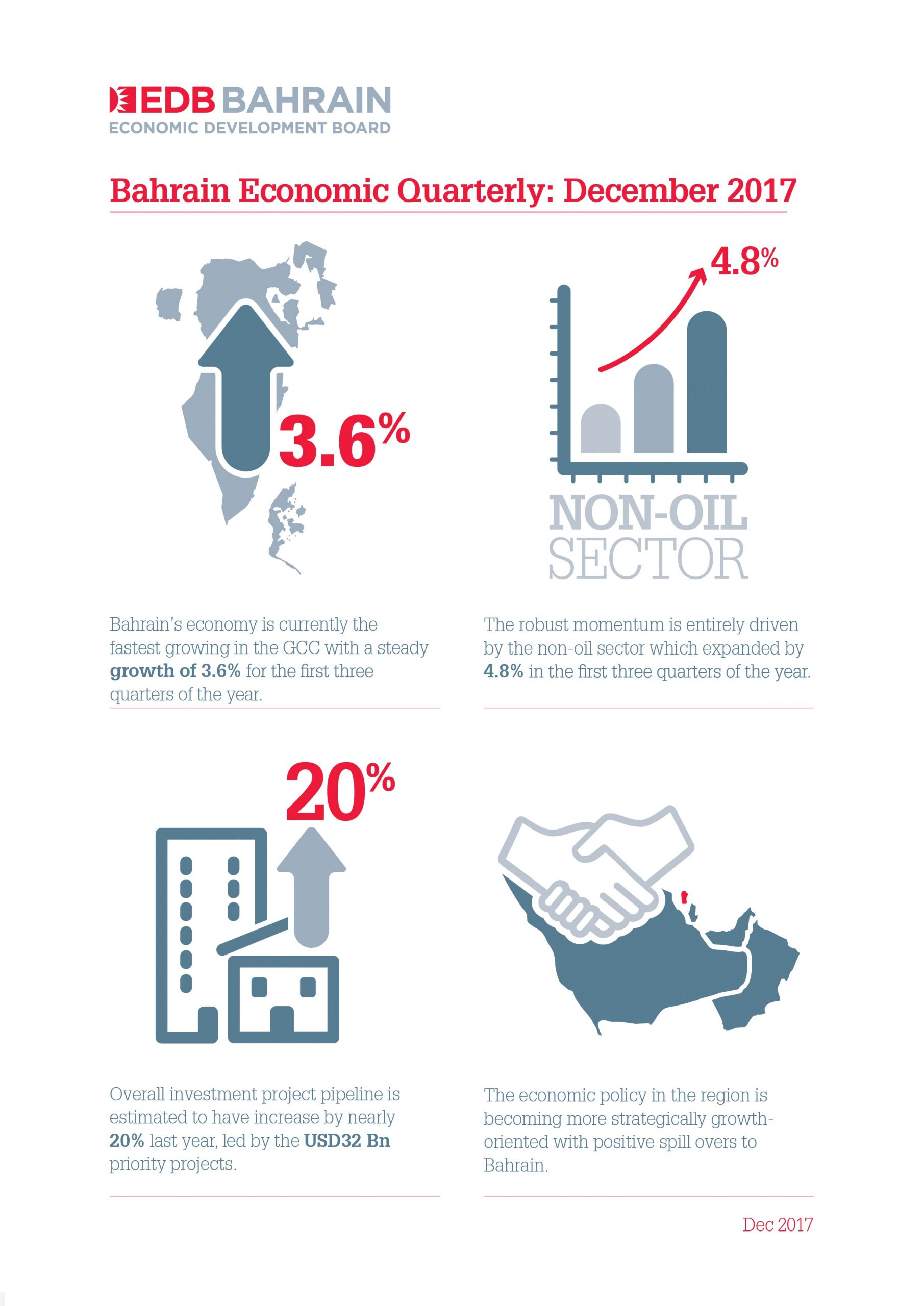

– Overall growth of 3.6% made Bahrain the fastest-growing economy in the GCC in the period –

– Momentum remains strong with estimates of non-oil growth in 2018 upgraded to 4.1% –

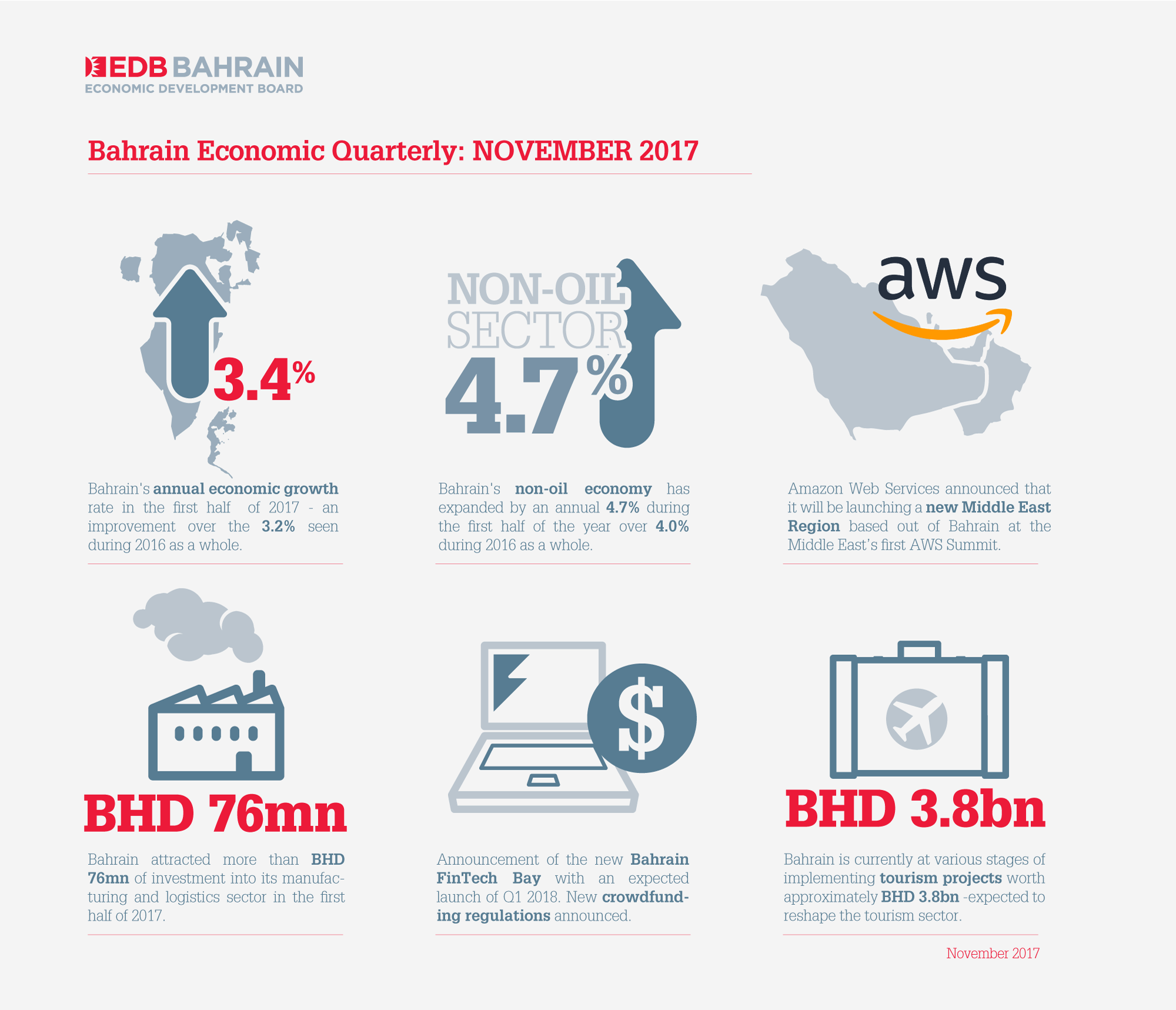

Manama, 12th February 2018: The growth momentum of the Bahraini economy has continued to exceed expectations, with the annual pace of growth in the non-oil sector reaching 4.8% in the first nine months of 2017. During 2017 as a whole, non-oil growth is expected to exceed the 4.0% pace recorded in 2016, according to the latest Bahrain Economic Quarterly published by the Bahrain Economic Development Board (EDB).

The performance of the non-oil private sector also meant that overall economic growth in the Kingdom reached an annual pace of 3.6% for the first three quarters of the year – improving on the 3.2% pace of growth posted during 2016 as a whole and making Bahrain the fastest growing economy in the GCC.

Speaking on the publication of the report, Dr Jarmo Kotilaine, Chief Economic Advisor of the Bahrain EDB, commented:

“Bahrain’s economy continues to deliver at the upper end of growth expectations thanks to a combination of robust structural and countercyclical drivers. We expect this positive dynamic to continue into 2018 as the regional environment becomes more supportive of growth and as the diversified economy continues to expand, supported by an unprecedented investment pipeline.”

“Alongside this strong recent performance, we are also seeing increasing efforts to position the country to take advantage of emerging growth drivers as the region’s economy undergoes a paradigm shift. As growth becomes increasingly underpinned by improvements in productivity, Bahrain’s investment in infrastructure, regulatory reform and development of human capital will play a vital role in ensuring long-term, sustainable prosperity and expansion,” added Dr Kotilaine.

Encouragingly, non-oil growth in Bahrain is almost entirely driven by the private sector at a time of fiscal austerity. The positive momentum is broad-based, characterised by strong performances across a number of areas. Hotels and Restaurants, Social and Personal Services, Transportation and Communications, and Financial Services all expanded more than 6% year-on-year real growth during the first three quarters of 2017. All of this points to the continued strong progress of economic diversification in an economy where the non-oil sector collectively already generate more than 80% of GDP.

While growth is benefiting from a range of structural drivers, non-oil growth is particularly boosted by large-scale infrastructure investments at a time of historically subdued oil prices and low government spending growth. The overall investment project pipeline is estimated to have increased by nearly 20% last year and is led by USD32bn worth of strategically important priority projects that are progressing according to plan. These range from the airport modernisation project to the expansion of the Alba aluminium smelter and the Bapco (refinery) Modernization Project. In many areas project implementation has been accelerating and this is set to continue in 2018. For instance, during 2017 as a whole, the value of tendered projects as part of the GCC Development Fund rose from USD3.9bn to more than USD4.1bn. The cumulative amount of money disbursed almost doubled from USD751mn in 4Q16 to USD1.4bn a year later.

Alongside a strong performance in the first nine months of 2017, Bahrain has also put in place a number of initiatives designed to position the Kingdom to benefit from future growth opportunities in emerging sectors.

In 2017, Bahrain implemented key pillars of the regulatory framework for FinTech, including the launch of a regulatory sandbox which has already accepted its first six entrants. Bahrain is also set to launch the first dedicated FinTech hub and corporate incubator in the Middle East and Africa region in February. Bahrain FinTech Bay will collaborate closely with the Central Bank of Bahrain, notably its new, dedicated FinTech and Innovation Unit, and the Bahrain EDB.

The Kingdom is also making substantial investments in its ICT infrastructure and ecosystem in a bid to make digitisation and creative tech-based entrepreneurship key drivers of economic activity. The second half of 2017 saw a number of events designed to drive the agenda forward. These included the Amazon Web Services (AWS) Summit, the Technology Week Tent, and the MIT Innovation Conference.

– Ends –

Notes to editor

Contact

Telephone: 17589966

About the Bahrain Economic Development Board

The Bahrain Economic Development Board (EDB) is an investment promotion agency with overall responsibility for attracting investment into the Kingdom and supporting initiatives that enhance the investment climate.

The EDB works with the government and both current and prospective investors to ensure that Bahrain’s investment climate is attractive, to communicate the key strengths, and to identify where opportunities exist for further economic growth through investment.

The EDB focuses on several economic sectors that capitalise on Bahrain’s competitive advantages. These sectors include financial services, manufacturing, ICT, tourism, logistics and transport.

For more information on the Bahrain EDB visit www.bahrainedb.com; for information about Bahrain visit www.bahrain.com.