Total inward FDI stock just under 90% of GDP above regional and global averages.

Active infrastructure pipeline provided continued momentum, with USD3.2bn worth of projects having already broken ground.

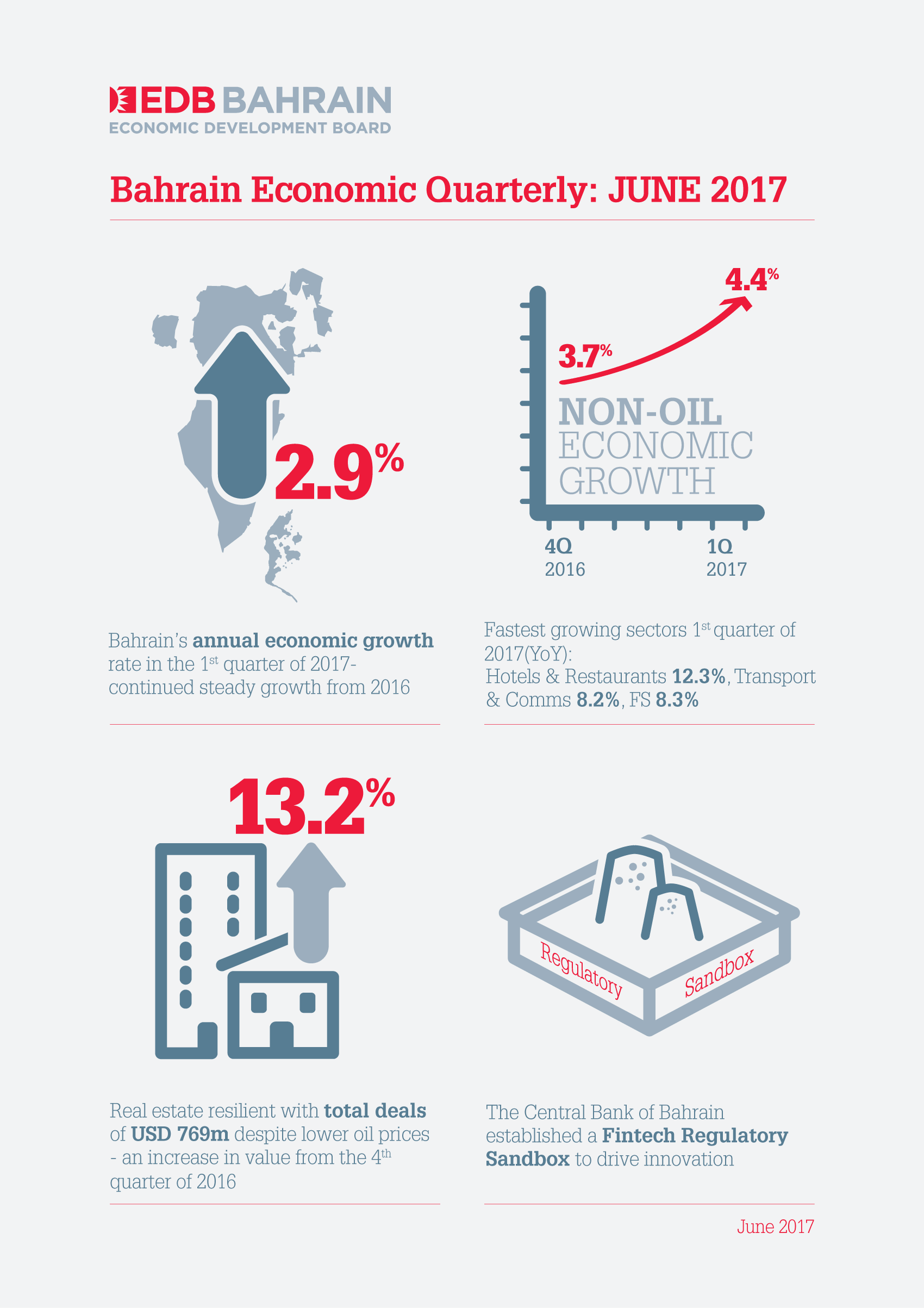

Growth in the non-oil sector of Bahrain’s economy reached 4.4% in the first quarter of 2017, up from 3.7% during 2016, according to the Bahrain Economic Quarterly published by the Bahrain Economic Development Board (EDB).

This growth was driven by strong performance across the non-oil private sector, with momentum continuing to be supported by large scale infrastructure projects. Overall, during the first three months of 2017 the Bahraini economy expanded by 2.9%, in line with the 3% pace seen in 2016 as a whole.

The first three months of 2017 saw particularly strong growth in the hotels and restaurants, financial services and transportation and communications industries. Hotels and restaurants emerged as the fastest growing single sector during Q1, posting a 12.3% year-on-year real rate of expansion and financial services continued along its strong growth trajectory reported last year, posting an annual expansion of 8.3% at the end of Q1 compared to 5.2% at the same in 2016. The transportation and communications sector also performed strongly, with an annual real growth rate of 8.2% in Q1.

Underpinning the near term momentum in Bahrain’s non-oil economy is the large amount of investment in infrastructure that the Kingdom is experiencing. This includes the USD3bn Alba Line 6 project – which is set to create the world’s largest single-site aluminium smelter. USD1.1bn is being invested in the airport modernisation programme and a further USD335m earmarked for a new Banagas gas plant. Expressions of interest have been solicited for the construction of the King Hamad Causeway which will add to the existing King Fahd Causeway, connecting Bahrain to Saudi Arabia and serving as a platform for the GCC railway.

Active projects that are part of the GCC Development Fund also saw a further increase in their aggregate value. The cumulative total worth of GCC Development Fund projects that had broken ground by Q2 of 2017 reached around USD3.2bn. This marks a 111.3% increase on the active pipeline from Q1 of 2016.

Speaking on the publication of the report, Dr. Jarmo Kotilaine, Chief Economic Advisor of the Bahrain EDB, commented: “As the region continues its transition in a low oil price environment, the Bahraini offers further encouraging indications both of its resilience and the progress of diversification. The Q1 growth figures are very encouraging and underscore the impact both of the Government’s reform agenda and the powerful countercyclical impact of the unprecedented infrastructure project pipeline.

“We are confident that recent initiatives such as the creation of a regulatory sandbox for fintech and investment in creating the world’s largest single-site aluminium smelter will continue to support growth and to make Bahrain an attractive destination for businesses looking to access the opportunities in the region.”